When it comes to acquiring an online business—especially when you’re working with a limited budget—being able to spot potential red flags is crucial. As someone who has navigated the digital marketplace from the ground up, I’ve learned that understanding these warning signs can mean the difference between a profitable investment and a costly mistake. In this article, we’ll dive into the essential red flags to watch for when buying a low-cost online business, and I’ll share my personal insights on how to mitigate these risks. We’ll also cover practical tips using long-tail keywords like “how to identify red flags when buying an online business on a budget” and “warning signs when buying a low-cost online business” to help you make an informed decision.

Why Vigilance is Key in Low-Cost Online Business Acquisitions

Investing in online businesses at an affordable price point opens up incredible opportunities for first-time buyers and entrepreneurs looking to diversify their portfolios. However, the lower price range can sometimes hide underlying issues that, if not uncovered early, can significantly affect your investment. Here’s why you need to be extra vigilant:

-

Limited Financial Cushion:

With a tighter budget, you have less room to absorb unexpected costs or losses. Every red flag you miss could lead to major financial setbacks.

-

Operational Risks:

Smaller online businesses might not have robust systems in place. A lack of streamlined operations can increase the risk of inefficiencies and hidden costs.

-

Growth Potential Concerns:

Some businesses may appear attractive at first glance, but poor long-term growth potential could limit your return on investment.

By learning how to identify red flags when buying an online business on a budget, you can better protect yourself from these pitfalls and position your new venture for success.

Red Flag #1: Inconsistent or Inflated Financials

What to Look For:

-

Fluctuating Revenue Patterns:

Beware of businesses with irregular income streams or sudden spikes in revenue that aren’t backed by clear explanations.

-

Lack of Detailed Financial Records:

Transparency is key. If the seller cannot provide detailed profit and loss statements, balance sheets, and cash flow reports, consider it a warning sign.

-

Unverified Revenue Claims:

Some sellers might exaggerate revenue figures. Verify the numbers through third-party analytics tools and, if possible, request access to the business’s payment processors or bank statements.

How to Mitigate:

- Perform a Deep Dive Financial Audit: Use long-tail keywords like “detailed online business financial audit checklist” to find tools and templates that can guide your review process.

- Consult a Financial Advisor: If you’re not confident in your ability to spot discrepancies, working with an accountant who specializes in digital businesses can save you from future headaches.

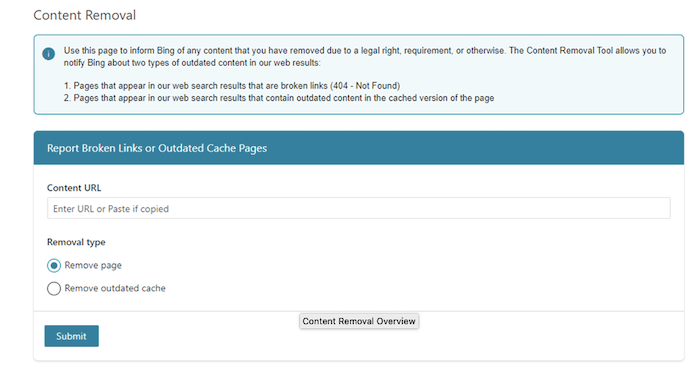

Red Flag #2: Poor Traffic Quality or Unverified Analytics

.jpg)

What to Look For:

-

Low-Quality or Bot Traffic:

High traffic numbers may look appealing, but if the traffic is largely non-human or coming from questionable sources, the value of the website diminishes.

-

Inconsistent Traffic Data:

Significant fluctuations in website traffic without clear reasons (such as seasonal trends or marketing campaigns) should prompt further investigation.

-

Limited Analytics Transparency:

A reputable business will have robust analytics data available through tools like Google Analytics, SEMrush, or Ahrefs. If the seller is hesitant to share this data, proceed with caution.

How to Mitigate:

- Use Third-Party Tools: Access free or paid tools that analyze website traffic quality and provide insights on bounce rates, session duration, and visitor sources.

- Ask for Detailed Analytics Reports: Request historical traffic data and compare it with industry benchmarks. Long-tail searches like “how to verify website traffic quality for online business” can lead you to step-by-step guides.

Red Flag #3: Outdated or Low-Quality Content and Technology

What to Look For:

-

Stagnant Website Design:

An outdated website can be a red flag, especially if it isn’t optimized for mobile or doesn’t follow modern UX/UI principles.

-

Poor Content Quality:

Content is a critical asset for online businesses. Low-quality, outdated, or unoriginal content may indicate that the business has not been well-maintained.

-

Technical Debt:

Outdated software, plugins, or a poorly managed hosting environment can result in security vulnerabilities and high future maintenance costs.

How to Mitigate:

- Conduct a Website Audit: Utilize long-tail keywords such as “online business website audit checklist” to find comprehensive guides on evaluating website design, content quality, and technical infrastructure.

- Plan for Upgrades: Factor in the cost of modernizing the website as part of your investment analysis. This foresight will help ensure that your acquisition has long-term growth potential.

Red Flag #4: Lack of Diversified Revenue Streams

What to Look For:

-

Reliance on a Single Income Source:

A business that depends entirely on one revenue stream—such as affiliate marketing, advertising, or a single product—can be risky. If that revenue stream falters, your entire investment could be jeopardized.

-

No Recurring Revenue:

Businesses with a recurring revenue model, such as subscription services, offer more stability. A lack of recurring revenue is a significant risk factor.

How to Mitigate:

- Diversification Strategy: When evaluating an acquisition, ask how the business can expand its revenue streams. Long-tail keywords like “how to diversify revenue streams in online business acquisitions” can lead you to case studies and expert advice.

- Revenue Analysis: Request a breakdown of all revenue channels and assess the potential for each to scale independently.

Red Flag #5: Unclear Ownership of Assets and Intellectual Property

What to Look For:

-

Disputed Ownership:

Ensure that the seller has clear, undisputed ownership of all assets, including website domains, trademarks, and proprietary content.

-

Licensing and Legal Issues:

If the business uses third-party software or content, verify that all licenses are in order and transferable to new ownership.

-

Unclear Contracts:

Contracts with vendors, customers, or partners should be well-documented and free of ambiguous terms that might complicate future operations.

How to Mitigate:

- Hire a Legal Advisor: Before finalizing any deal, consult with a lawyer experienced in digital business acquisitions. They can help you verify that all assets and intellectual property rights are in order.

- Request Documentation: Ask for copies of all relevant contracts, licenses, and legal documents to review for any potential red flags.

Red Flag #6: Over-Reliance on the Current Owner

What to Look For:

-

Key Person Dependency:

Some online businesses are heavily reliant on the owner for content creation, customer relationships, or strategic direction. If the business can’t function without the current owner, transitioning ownership may be problematic.

-

Lack of Automation:

Businesses that depend on manual processes or the personal involvement of the owner are less scalable and more vulnerable to disruption.

How to Mitigate:

- Assess Transition Plans: Ensure that the business has documented processes and systems that will allow for a smooth transition. Look for long-tail keywords like “creating a transition plan for online business acquisition” for templates and advice.

- Evaluate Automation Potential: Identify areas where you can implement automation to reduce dependency on any single individual. This strategy not only mitigates risk but also enhances scalability.

Red Flag #7: Insufficient Customer Engagement and Loyalty

What to Look For:

-

Low Customer Retention Rates:

A business with a high churn rate or low customer loyalty can signal problems with product quality, customer service, or market fit.

-

Limited Social Proof:

Positive reviews, testimonials, and active social media engagement are indicators of customer satisfaction. Their absence may be a red flag.

-

No Community or User Base:

For many online businesses, building a loyal customer base or community is key to long-term success. A lack of community engagement might indicate that the business struggles to create lasting relationships with its audience.

How to Mitigate:

- Conduct Customer Surveys: If possible, get in touch with existing customers to understand their level of satisfaction and loyalty.

- Analyze Engagement Metrics: Use analytics tools to review metrics like repeat visitor rates, customer reviews, and social media interactions. Search for “how to analyze customer engagement metrics for online businesses” to find more detailed guidance.

Practical Steps to Validate Your Findings

Identifying red flags is only the first step. Once you’ve compiled a list of potential warning signs, it’s essential to validate your findings through additional due diligence:

Step 1: Document Your Observations

- Create a Checklist: Develop a comprehensive checklist of red flags and go through each one systematically for every potential acquisition.

- Score the Business: Assign scores or weights to different red flags to help quantify the overall risk. This approach will give you a clearer picture of whether the business meets your risk tolerance.

Step 2: Verify Through Third-Party Tools

- Use Analytics Software: Leverage tools like Google Analytics, SEMrush, or Ahrefs to verify traffic and engagement data.

- Financial Verification Tools: Consider third-party services that specialize in verifying online business financials. This extra layer of scrutiny can help ensure that the numbers add up.

Step 3: Consult with Experts

- Seek Professional Advice: Don’t hesitate to engage with accountants, legal advisors, or business consultants who specialize in online business acquisitions. Their expert insights can help confirm or refute your concerns.

- Join Industry Communities: Participate in forums and social media groups where other digital entrepreneurs share their experiences. Often, a seasoned investor’s perspective can shed light on potential red flags you might have overlooked.

Buying an online business on a budget can be an incredibly rewarding venture if approached with caution and diligence

While low-cost opportunities are attractive, they often come with hidden challenges. By learning how to identify red flags when buying a low-cost online business, you can protect your investment and position yourself for long-term success.

Here’s a quick recap of the red flags to watch out for:

- Inconsistent or Inflated Financials: Verify revenue and ensure transparency in financial documentation.

- Poor Traffic Quality: Look beyond vanity metrics and verify genuine engagement.

- Outdated Content and Technology: Ensure that the website and underlying systems are up-to-date.

- Lack of Revenue Diversification: Favor businesses with multiple income streams.

- Unclear Ownership of Assets: Confirm that all intellectual property and contractual obligations are in order.

- Over-Reliance on the Current Owner: Assess whether the business can operate independently post-transition.

- Insufficient Customer Engagement: Prioritize businesses with loyal, engaged customer bases.

Remember, thorough due diligence is your best defense against costly mistakes. While no investment is entirely risk-free, taking the time to identify and address these warning signs can drastically improve your chances of success. Use this guide as a roadmap to ensure that every potential acquisition is evaluated not just on its price tag, but on its long-term viability.

As you embark on your journey to purchase an online business on a budget, keep refining your checklist and learning from each acquisition. The insights you gain will not only protect your current investments but also pave the way for a scalable and profitable portfolio in the digital marketplace.

Happy hunting, and here’s to making smart, informed investments that build your entrepreneurial future!

Mar 08, 2025

Mar 08, 2025

Prev Post

Prev Post

What do you think?

Show comments / Leave a comment